According to the report, the business landscape has entered what experts describe as an AI super cycle, characterised by technological advancement and investment. This acceleration is igniting business transformation initiatives aimed at enhancing growth while uncovering new operational efficiencies.

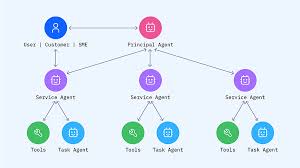

Financial services organisations stand to benefit significantly from AI agents – sophisticated software entities that can assess situations, gather and process data to problem-solve, autonomously execute tasks and learn from interactions, with minimal human input. These AI agents eliminate friction points which traditionally required multiple human interactions, enabling seamlessly integrated customer experiences.

“Australia’s financial institutions are increasingly addressing demand for agentic AI as they evolve beyond automation toward systems capable of goal setting, decision-making, and real-time learning,” said Richie Paul, Generative AI and Strategy and Transformation Lead at IBM Consulting.

“Yet, the transformative potential of AI will only be fully realised when organisations can confidently delegate both routine and complex tasks to AI systems, freeing human talent to focus on strategic and higher value activities. This delegation capability represents the critical inflection point for AI value creation,” added Richie.

Reimagine risk management for autonomous AI systems

The autonomous nature of AI agents exacerbates some challenges of traditional AI and introduces new risks. Successfully scaling AI agents and driving trust in them is a socio-technical challenge that needs a holistic approach across organisational culture, governance protocols, tools and AI engineering frameworks.

“Building trust in AI agents is non-negotiable,” said Michal Chorev, AI Governance Lead at IBM Consulting. “This necessitates implementing organisational and technical guardrails across diverse use cases and deploying real-time monitoring systems to ensure AI actions remain safe, reliable, and aligned with organisational objectives.”

“Current AI governance frameworks must evolve to address the amplified risk associated with agentic AI,” said Michal. “Critically, those leaders accountable for AI outcomes need both the authority and resources to effectively perform their role.”

Ensuring compliance by design

The whitepaper advocates for ‘compliance by design’ – a proactive approach where risk mitigation strategies are developed alongside AI systems rather than retrofitted afterward. This integrated approach ensures alignment with organisational risk tolerance while validating use cases before significant resource commitment.

“Our financial services clients are actively working to maximise returns on their AI investments and partnerships,” said Joe Royle, AI Strategy Lead at IBM Consulting. “As they innovate at accelerated speed to transform both customer and employee experiences, establishing effective governance and controls becomes increasingly vital to mitigate associated risks and support successful transformation.”

Critical considerations

The research also highlights a number of other critical considerations for financial institutions in rolling out AI agents:

The shift to adaptive technology services: AI agents enable a paradigm shift from responsive to adaptive technology services, creating more accessible, personalised banking services and experiences for customers.

Strategic, phased adoption is essential: Organisations must adopt a measured, phased approach balancing innovation with comprehensive risk management, through thorough assessments, clear governance structures, talent development, and continuous monitoring.

Cross-functional collaboration: Successfully managing agentic AI requires seamless cooperation across business functions, supported by transparent governance structures and communication channels.

Enhanced risk controls: Understanding where new risks emerge and implementing appropriate controls is essential, recognising agentic AI as a fundamentally different technological paradigm requiring new approaches to governance and controls.

Comprehensive AI literacy programs: Organisations must develop holistic AI literacy programs – including philosophy, linguistics, law, and anthropology—to formulate and responsible AI strategies and address potential model biases.

Commenting on the report’s findings, David Ellis, IBM Consulting’s Managing Partner for Australia, said: “Agentic AI has emerged as a core driver of innovation and banking transformation. While presenting exciting opportunities for the financial services sector, it also introduces unique challenges that must be addressed proactively.”

“Through strategic planning, robust risk management frameworks, clear control mechanisms, effective supervision and unwavering commitment to responsible AI practices, financial institutions can confidently and safely navigate this new AI frontier.”