Regulatory compliance is becoming more complex, and businesses in different industries face stricter rules for verifying customer identities and processing sensitive documents. At the same time, fraudsters are using advanced methods to falsify bank statements, IDs, and invoices, putting companies at risk of financial losses and compliance violation.

Traditional document verification methods, like manual reviews and physical document checks, are slow, expensive, and prone to human error. As a result, businesses are looking for smarter solutions to automate document verification, reduce fraud, and ensure regulatory compliance more efficiently.

Automated document verification software powered by AI is changing the game. By using optical character recognition (OCR) in combination with AI, businesses can verify documents in seconds, ensuring both compliance and security without the inefficiencies of manual checks.

But how exactly does this technology work, and why is it becoming important to modern businesses?

What is automated document verification?

Automated document verification is a process that authenticates documents like passports, IDs, bank statements, and invoices in real time. Instead of relying on manual reviews, AI-powered solutions scan, extract, and validate data, significantly reducing the risk of fraud and human error.

How does it work

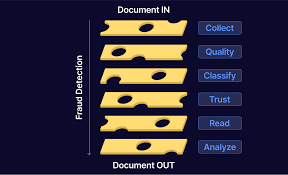

Automated document verification relies on two key technologies: OCR, and AI. Together, these technologies streamline the verification process, ensuring documents are authentic and compliant with regulatory standards.

OCR: Extracting and structuring data

Optical character recognition is the first step in document verification. It converts scanned or digital documents into machine-readable text, allowing businesses to extract key data like:

Names, dates, and addresses from IDs or passports

Financial figures from bank statements and invoices

Company details from business registrations

OCR eliminates the need for manual data entry, reducing errors and accelerating document processing. However, basic OCR alone is not enough to detect fraud; that’s where AI comes in.

AI: Detecting fraud and verifying authenticity

Once OCR extracts text and data, AI takes over to analyse the document for authenticity and potential fraud. By recognising patterns and detecting anomalies, AI strengthens security and ensures compliance. It can:

Identify inconsistencies in fonts, layouts, and document structures

Detect altered or manipulated data that may not be visible to the human eye

Analyse metadata to flag suspicious modifications

Recognise duplicate or falsified documents used for fraudulent purposes

AI continuously learns from new data, improving accuracy over time. The advanced verification process ensures businesses can confidently process documents while minimising fraud risks.

Conclusion

Keeping up with compliance regulations while staying ahead of fraud is an unchanging challenge for businesses. Manual document verification is slow, costly, and prone to human error, but AI is changing the game.

With automated document verification, companies can instantly verify identities, detect fake documents, and ensure compliance with regulations like KYC, AML, GDPR, and HIPAA. Powered by OCR and AI, this technology scans and analyses documents in seconds, preventing fraud before it happens.

Industries like finance, e-commerce, and healthcare are already reaping the benefits. Whether it’s bank statement verification for loans, stopping loyalty fraud in e-commerce, or securing patient records in healthcare, AI-driven solutions are making verification faster, smarter, and more secure.