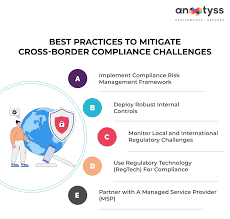

Operating across borders is challenging for any business, but it’s especially difficult for medium-sized companies that lack the resources to navigate multiple regulatory frameworks. The ongoing trade war and broader geopolitical uncertainty further complicate these efforts, increasing risks and unpredictability in global markets. As a result, these businesses must carefully evaluate their international expansion strategies.

New research by global corporate service provider Vistra finds that staying on top of compliance obligations is the biggest single challenge for Asia businesses, when they set up and maintain a legal entity in another country. Between September 2024 and January 2025, Vistra surveyed 250 senior decision-makers from multinational companies, financial services and professional services firms in China, Hong Kong and Singapore to garner insights around this very point.

Keeping up with different rules affects countries and industries differently, according to the research. Companies in Hong Kong and Singapore struggle most with keeping up with all requirements, as do banks, investment management companies and corporate service providers. Chinese companies are most concerned about fulfilling anti-money-laundering and know-your-customer obligations, while for family offices and consulting firms it is most difficult to ensure data protection.

According to Hailiang Zhang, Vistra’s Executive Vice President, Global Solutions for North Asia, these obligations are a bigger burden on medium-sized companies than on big corporations with large compliance teams or smaller players that may operate with less regulatory scrutiny. “Medium-sized companies face a particularly significant challenge in meeting compliance obligations, due to lack of in-house expertise and technological support,” says Zhang.

For this ‘squeezed middle’, managing compliance can strain limited resources and require significant investment in legal and compliance functions.

“Some of the challenges we face include laws and regulations that change frequently,” says Chloe Sung, general counsel at ZA, a Hong Kong-based digital financial group. “Keeping up with these changes demands substantial resources, which can slow down our business growth.”

China’s Personal Information Protection Law (PIPL) and its new cross-border data transfer compliance procedures, which require security assessments when transferring Chinese personal data abroad, can be particularly onerous. “These stringent requirements make it more difficult for us to provide services to customers who are travelling,” says Sung.

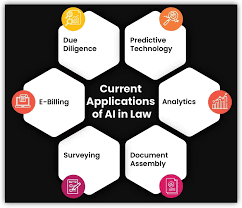

Artificial intelligence could offer medium-sized companies a lifeline. AI tools can monitor regulatory changes across multiple jurisdictions so that businesses stay updated with evolving compliance requirements, with natural language processing algorithms helping to analyse new laws and summarise obligations. And AI can perform regulatory audits to help businesses identify and fix any compliance gaps. Employees can also improve their compliance skills using AI-driven adaptive training platforms.

“Compared with a couple of years ago, the adoption of AI has accelerated due to advancements in machine learning and natural language processing,” says Zhang, who believes that use of AI will accelerate as firms realise they can use it to increase productivity more widely. The research reveals that decision-makers are confident that AI can enhance legal entity management, notably by automating data collection and processing, improving risk management and boosting fraud detection and prevention.

But regulators worldwide have not caught up with the rapid growth of AI, so many firms are unclear about compliance when they use the technology for regulated activities. For example, there is no comprehensive Hong Kong framework governing AI’s broader application in compliance, account opening and risk management.

These regulatory gaps create uncertainty for companies and limit their use of AI across their operations. Zhang explains how Vistra navigates these challenges: “For us, AI is a tool to enhance and support the expertise of our real-world experts,” he says. “In a business focused on safeguarding compliance, AI must be closely monitored and carefully managed to ensure our clients gain all the benefits without being exposed to unnecessary risks.”

Sung elaborates. “We use AI tools to streamline legal analysis and expedite our work. For example, we integrate AI into our account opening and compliance processes. But only as part of the overall monitoring framework – not the entire process.”

Jurisdictions including China and South Korea are trying to create regulatory frameworks that encourage AI adoption while addressing its risks. When these frameworks come into effect, businesses will have greater opportunities to harness AI’s potential.

Medium-sized businesses also have a balancing act to master: staying compliant without holding back their growth. With regulatory complexities persisting and economic volatility increasing, that will mean a combination of advanced technologies and proactive compliance strategies. Companies that effectively manage these demands will be well-positioned for successful cross-border expansion.